what to do if tax return is rejected

Then repeat the Filing step to resubmit your return. Heres your next move in that situation.

How To Handle A Tax Return Rejected By The Irs

I have been reading that people have been getting their returns rejected and dont want to deal with that headache.

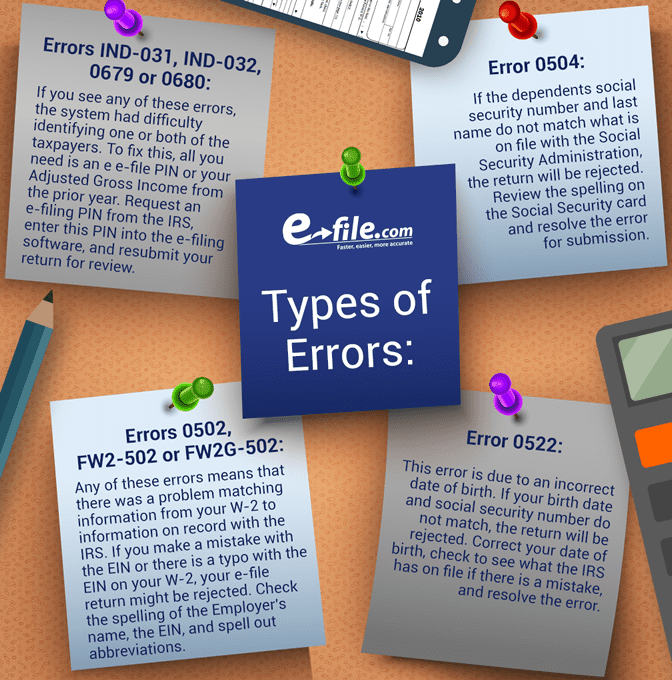

. Use a fillable form at IRSgov print then attach the form to your return and mail your return according to instructions. There are a few possible reasons why youre still getting an e-file reject. You can get a tax return rejected by the IRS for several reasons such as a misspelled name inaccurate information on a dependent or entering an incorrect date of birth.

Whether you received an error code or not to find out the cause of your rejected tax return youll need to review the paperwork you filed. Having your tax return rejected isnt necessarily an immediate cause for concern. The IRS doesnt tend to reject returns that.

If your e-filed return is rejected because of a duplicate filing under your Social Security number or if the IRS instructs you to do so complete IRS Form 14039 Identity Theft Affidavit PDF. The first thing to do is reach out to a tax expert to guide you through the investigation. I havent completed it just yet but I was asking this because it asked for 2020s AGI but for me it was 0 because I filed for the stimulus payment.

This device is too small. However it would help if you also. To fix and refile your return select Fix it now or Revisit and TurboTax will guide you through fixing and refiling your return.

Contact the IRS to verify. The code is in the email you received and in TurboTax after selecting Fix my return. Review Your Return.

Amended your return last yearmake sure youre using the. Most times the rejection comes with an explanation giving details of the reason. No one likes rejection even if it comes from the taxman.

You need to know why your tax returns were rejected. Accidental errors made in haste can get your tax return rejected or your tax refund delayed sometimes for months. Remember if your original return was filed by the due date and was rejected theres no need for you to worry.

If your Social Security Number name or a number from your W-2 was incorrectly typed into your return and caused your return to be rejected review and correct your personal information entries in Basic Information of the Federal QA. Up to 25 cash back My tax return was rejected 1132- Schedule M economic recovery payment does not match IRS records. You can even solve the problem online and send back the electronic file.

The last thing you want to do is be rejected for an e-filed 2021 return and then be stuck filing a paper return which could trigger an extraordinary delay of the 2021 refund. Tax returns are rejected because a name or number in the tax return does not match the information contained in the IRS databases or the Social Security Administration. Spelling and typo errors can be quick and easy to correct.

There is one trick that millions of taxpayers still need to learn as the April 18 filing deadline approaches. This is easier if you do have an. There are different factors that could cause a tax return to get rejected.

If youre one of the millions of Americans still waiting on your 2020 tax return youll need to take a special step to avoid a rejection for this years electronic filing according to the IRS. Find out if youre getting a refund File Your Taxes. If you are mailing a paper return you have until the actual due date of the return generally April 15 or 10 calendar days after the IRS gives notification that the return was rejected whichever is later to get it back to the IRS.

The primary causes of tax return rejection are minor errors like incorrect spelling or identification numbers. If youre on a Galaxy Fold consider unfolding your phone or viewing it in full screen. Tax return rejections are typically the result of typos or math errors.

Tax season has started and the IRS will reject some tax returns. To fix your rejected return first find your rejection codeit indicates the reason your return was rejected. An important point to note here is that in case there are mathematical errors the IRS generally takes care of them themselves and do not count them as errors.

I made a mistake by entering 25000 I took this out of my returns but how do I refile James Beauchamp. Another question if the line Form. There are different factors that could cause a tax return to get rejected.

Why do tax returns get rejected. You may need to include an explanation with the paper return when you send it in. Op 20 min.

Fixing an IRS Rejected E-File. If you want to receive your full tax refund on. There are additional cases wherein you would have entered the wrong gross income amount from the previous tax years return.

The IRS considers your return on time as long as you made the corrections and file it again within five business days. No one likes rejection especially when it comes in the form of a rejected tax return. To be sure an e-filed return may be rejected for a variety of reasons including if you are a victim of identity theft and someone filed a tax return using your stolen Social Security number prior to you.

Filed late last year after mid-November or your return was processed after that timetry entering 0. Heres your next move in that situation. The IRS considers your taxes unfiled if the agency rejects your return so its crucial to.

But you should figure out why the IRS rejected it and submit a corrected return as quickly and accurately as possible. If the amended returns are rejected again you may need the help of a tax expert. Add a header to begin generating the table of contents.

Article What Are Some Common Tax Myths Link Inside Gain Followers Argument Irs

Eidl Rejected Unable To Verify Information Cost Of Goods Sold Tax Return Business Owner

Planning To Take Home Loan Then Be Ready For 3 Year S Income Tax Returns Oops Don T Have Them Then Just Rush Income Tax Return Income Tax Tax Return

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Are Irs Security Tools Blocking Millions Of People From Filing Electronically

Form 2290 Due Date Irs Forms Irs Tax Refund

How Do I Fix A Rejected Return Turbotax Support Video Youtube

What To Do When Your Tax Return Is Rejected Credit Karma Tax

How Do I Find Out If My Tax Return Is Accepted E File Com

If Irs Rejects Your Form 2290 Here Is How You Correct Them Rejection Irs Forms Correction

Tax Return Rejection Codes By Irs And State Instructions

What Happens If I Have My Tax Return Rejected The Motley Fool

Irs E File Rejection Grace Period H R Block

You Could Be Filing A Faulty Tax Return Here S How To Avoid Getting It Rejected Tax Return Tax Income Tax Return

You Could Be Filing A Faulty Tax Return Here S How To Avoid Getting It Rejected Tax Return Income Tax Income Tax Return

What To Do When Your Income Tax Return Itr12 Is Rejected By Sars On Efiling Due To A Directive Youtube

How To Correct An E File Rejection E File Com

How To Report Tax Fraud To The Irs Financial Information Irs State Tax